An $85 Billion Railroad Merger is in the works. No one's happy about it.

In late July, Union Pacific announced their plans to merge with Norfolk Southern in a megadeal that would create nation’s first transcontinental railroad. No one's happy about it.

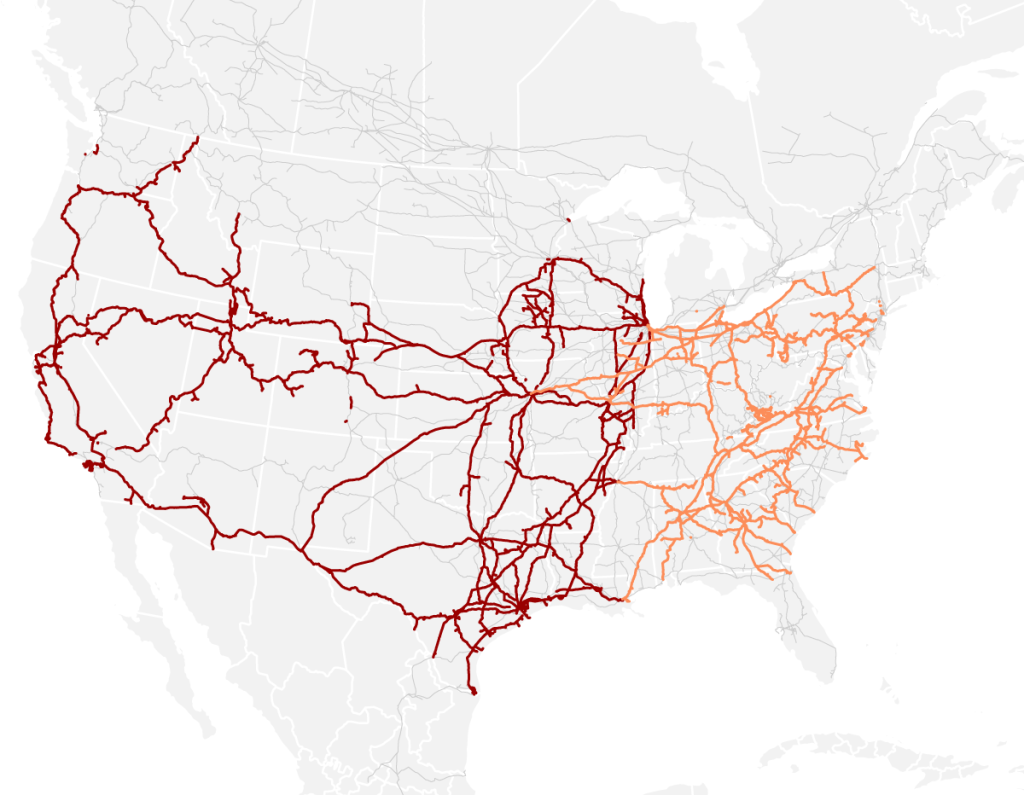

In late July, Union Pacific announced their plans to merge with Norfolk Southern in an $85 billion megadeal that would create the nation’s first transcontinental railroad. If successful, nearly half of United States rail freight would be transported by a single company, with the network spanning 43 states and nearly 50,000 miles.

Executives from both Union Pacific and Norfolk Southern have praised the deal, saying that the newly expanded company would bring efficiency and more jobs to America’s Class One rail network. In an interview with the New York Times at the end of July, Mark George, chief executive of Norfolk Southern, said “By coming together, we’re going to be able to get on a growth trajectory again, and that means more jobs.” The Surface Transportation Board, which will need to approve the merger, received notice of the companies’ intent to file on July 30.

The news of the merger has sent shockwaves through the railroading community, investment circles, and amongst shippers who use the rail lines to ship their freight across the United States. Activist investors like Ancora and Toms Capital have both separately increased pressure on CSX's board to pursue potential merger plans with BNSF in response to the merger announcement.

If this second megamerger were to happen, it would radically transform the state of the rail industry in the United States. “[If BNSF and CSX merge], we’d be down to just four railroads controlling not just the United States rail industry, but the actual infrastructure. That would be like four trucking companies owning the interstate highway system,” said Ron Kaminkow, organizer with Railroad Workers United.

Recently the American Chemistry Council, a trade group representing chemical producers in the United States, has said that the merger would raise costs on consumers and reduce competition. Chris Jahn, CEO of the American Chemistry Council told Trains Magazine on Sept. 4 that “The additional costs that are the likely result of this merger are ultimately going to hit everyday Americans. We urge regulators to reject this deal, unless it clearly enhances freight rail competition and improves service.”

According to reporting from Trains Magazine, Union Pacific and Norfolk Southern competitors have launched a number of intermodal partnerships in the wake of the merger announcement as a way to shore up competition against the would-be rail behemoth. "Last month BNSF and CSX announced an intermodal partnership that will offer seamless domestic coast-to-coast service, plus new international service linking BNSF’s Kansas City terminal with CSX-served ports on the East Coast," wrote Bill Stephens at Trains Magazine on Sept. 10. "And on Monday CSX and Canadian National unveiled plans to develop new interline intermodal service linking Nashville, Tenn., with Vancouver and Prince Rupert, British Columbia, via interchange at Memphis. BNSF, CSX, CN, and Canadian Pacific Kansas City executives have all said that Class I mergers are not necessary and that they will focus on interline partnerships that can offer shippers more options today."

For workers, fears of job insecurity and precarious system meltdowns

As the news of the merger has settled into the railroading community, nearly every labor union involved in the railroads has come out in opposition to the deal, calling it horrible for workers. “Union Pacific has a shameful safety record and was caught by the federal government trying to meddle in a safety audit. There is no world where Union Pacific should be controlling a coast-to-coast rail network,” said TWU International President John Samuelsen in a statement. “A supersized Union Pacific would be catastrophic for TWU rail workers, shippers, and the safety of millions of Americans who live and work near freight rail lines.”

Many workers that Words About Work reached out to expressed extreme concern at the impact a merger of this size would have, particularly as it relates to safety and job security. "The Norfolk Southern members who contacted me [after the merger announcements] are worried about their jobs," said Matt Weaver, Legislative Director with BMWED Ohio. "Mergers are made to cut jobs," he continued. It’s likely that any redundancies between the two companies (i.e. train inspection stations, maintenance warehouses, and other items) would be eliminated after the merger is complete, with no guarantee that those jobs wouldn't go with them.

Plenty of things can go wrong if the system merge isn’t planned carefully enough–keep in mind that a merger of this size wasn’t something even George Jay Gould, son of noted robber baron and Gilded Age railroad magnate Jay Gould, could accomplish. We haven’t seen a transcontinental railroad owned by one company before.

Additionally, memories of past mergers have stoked new fears that rail systems may not be able to handle the strain of a merge of this size. Many veteran railroaders remember at least one past merger that resulted in chaos. Often rail carriers will have their own proprietary scheduling and infrastructure technology. When a merge happens, if they haven’t allowed for enough time to settle issues between the two systems, a ‘meltdown’ can occur. During a meltdown, freight traffic can hit bottlenecks due to unclear scheduling, workers find themselves out of work, and safety to the community can decrease significantly.

In 1996, when Union Pacific merged with Southern Pacific railroad, a significant meltdown occurred that snarled freight traffic for months. According to reporting a few years after the fact, “Shipments that were supposed to take five days to reach their destinations often took as many as 30 -- if they didn't get lost altogether. Overburdened computer systems lost track of freight cars. Bottlenecks arose throughout the West -- particularly in Houston, where freight snarls lasted for a year and a half.”

If you were worried about the supply chain problems that occurred during the pandemic, then this upcoming mega-merger between two of the largest Class 1 Freight Carriers might make you a little queasy. Plenty of things can go wrong if the system merge isn’t planned carefully enough–keep in mind that a merger of this size wasn’t something even George Jay Gould, son of noted robber baron and Gilded Age railroad magnate Jay Gould, could accomplish. We haven’t seen a transcontinental railroad owned by one company before.

As a result, workers are viewing this merger with a healthy dose of skepticism. “[For] those of us who have lived through a merger or takeover, things didn’t get better. And for those who understand what’s going on in the rail industry, I don’t think there’s a whole lot of naivety left out there,” said Kaminkow said. “Everything’s a mess because everything’s out of sorts, and there’s a chance that this will happen. There’s never been a merger anywhere close to how big this merger will be, and the discombobulation can result in decreased safety when people are overworked, when they’re fatigued, and when they’re stressed.”

Ultimately, a merger of this size seems only to be supported by the investors and CEOs driving it forward. “[UP and NS] will be hard at work lobbying the government and the regulatory industries, like the Federal Railroad Administration, which what they’re doing right now, demanding cuts to various red tape and regulation so that they can make more money and theoretically move more freight, make more profit, and have a better rail industry,” Kaminkow said. “But you can’t convince the workforce that cutting safety regulations that have been in place for decades is any way to run a railroad.”

Comments ()